Five outdated beliefs that hurt your portfolio performance

By Lizelle Steyn

18 September 2019

After so many years in the investment industry one would think that I’ve mapped out the perfect financial plan for myself by now. Well, I thought I had. But the truth is that the majority of corporate employees are burrowed so deeply into their areas of specialisation that, if the morning breeze carried news of any exciting new developments in their industry that you could boost their portfolio performance, they’d hardly catch a whiff of it.

The past two months’ sabbatical has allowed me to lift my head above daily chores to explore what’s new and note-worthy on the local investment scene. And my heart missed a beat. How and when did I fall this much behind?

'Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.' ― John Kenneth Galbraith

Here are my five main investment beliefs that hurt my portfolio performance, and which are being shaken up this year.

1 The best investment platform will continue to lead the pack.

I started full-time work at 21 but until age 28 I invested nothing – nada. All my savings went into travelling. Then I spent about two years working in the UK, cozying up with several adults in one house to save costs and squirrel away savings for my first apartment back home. Re-entering the SA corporate scene, I invested the bare minimum my employer would allow in the company retirement fund, so that there would be money left of my salary every month to kill my bond before age 35. It’s only when I left the company shortly after reaching that milestone that I decided – instead of blowing everything on overseas travel as usual – to rather preserve my retirement savings. It was time to investigate the investment platforms available in SA at that time.

In 2007 even the employees of its competitors agreed on one thing: based on performance, ease of transacting and client service Allan Gray stood head and shoulders above the rest.

For the first time in SA, retail investors:

- Could open an investment account online

- No longer needed to make an EFT and submit proof of payment (Allan Gray can take the money directly out of your bank account)

- Didn’t need to supply FICA documents upfront for a retirement investment

- Could transact online, i.e. withdraw or add money to an existing account in seconds

- No longer needed to pay up-front fees

In 2019 all of this sounds pretty ordinary, but back then it was revolutionary. Allan Gray was the exciting new kid on the block tech-wise. Add to that a call centre packed with graduates that all underwent a 6-month rigorous training program before being let loose on clients, a pioneering client management system so you never have to repeat yourself or explain anything about your investment history, a simplified product range, plain English contracts and above-average long-term performance, choosing an investment platform was a no-brainer.

But the world has changed and I didn’t bother to keep up with other product providers. Until now.

Other than client service that’s in a class of its own and perhaps the automatic collection of money from your account and a simplified product range, most of Allan Gray’s advantages in 2007 have been crowded out by competitors. Currently Allan Gray offers only one provider of passive investment (index trackers) on its platform. And unlike other platforms like Glacier it’s not yet offering exchange-traded funds (ETFs), all which is making it an expensive way to invest. In the days of double-digit performance, one didn’t notice the high fees that much, but after five years of almost flat returns relative to inflation it’s become impossible to ignore the ongoing fees of the platform’s active fund offering and Allan Gray’s own admin/platform fee on top of those. Fees are clearly busy chipping away at my portfolio returns.

(On the topic of fees, it’s easy to become overwhelmed by all the different types of charges. I simplify it for myself by investigating three categories of fees for each product provider:

- fees at an adviser level, which is not applicable to DIY or so-called direct investors

- fees at a platform or product level, which are also called the admin fees

- fees at an underlying fund level, whether you choose a unit trust fund or an exchange-traded fund (ETF). The fees at fund level are summed up by the total expense ratio (TER) of your chosen underlying unit trust or ETF and found online on its fund fact sheet or minimum disclosure document)

2 Monitoring everything on one platform is worth the annual costs.

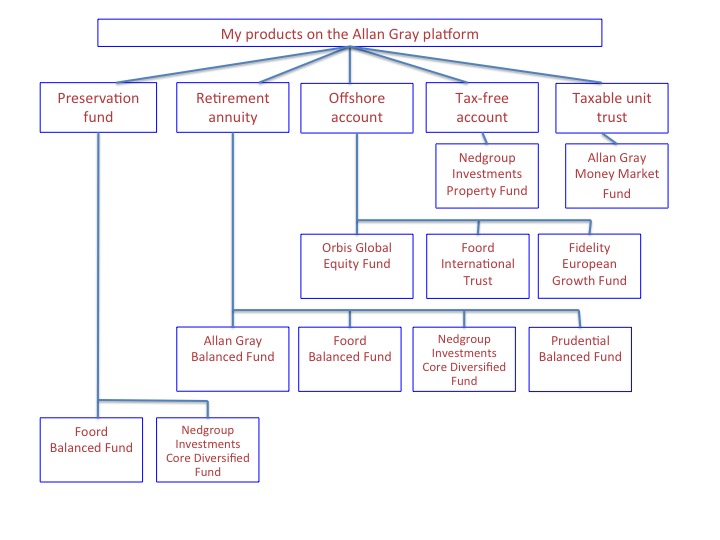

Over the years I’ve bought several products - a preservation fund, an offshore account, retirement annuity, normal unit trust and, most recently, a tax-free account – all via the Allan Gray platform. Not all of these products had Allan Gray unit trusts as their underlying fund building blocks, though. To diversify, I also chose Foord, Nedgroup, Fidelity and Prudential’s funds.

Image 1 (above): My products on the Allan Gray platform (2019). Each product has different tax and liquidity rules and fulfil a different role. The products don't change; the underlying funds do as I switch when needed.

It’s been convenient to have all my investments in one place. That means:

- I can see exactly how much offshore and local equity, fixed income and property exposure I have on average when you clump all my products together, and

- I receive tax certificates from only one service provider – Allan Gray.

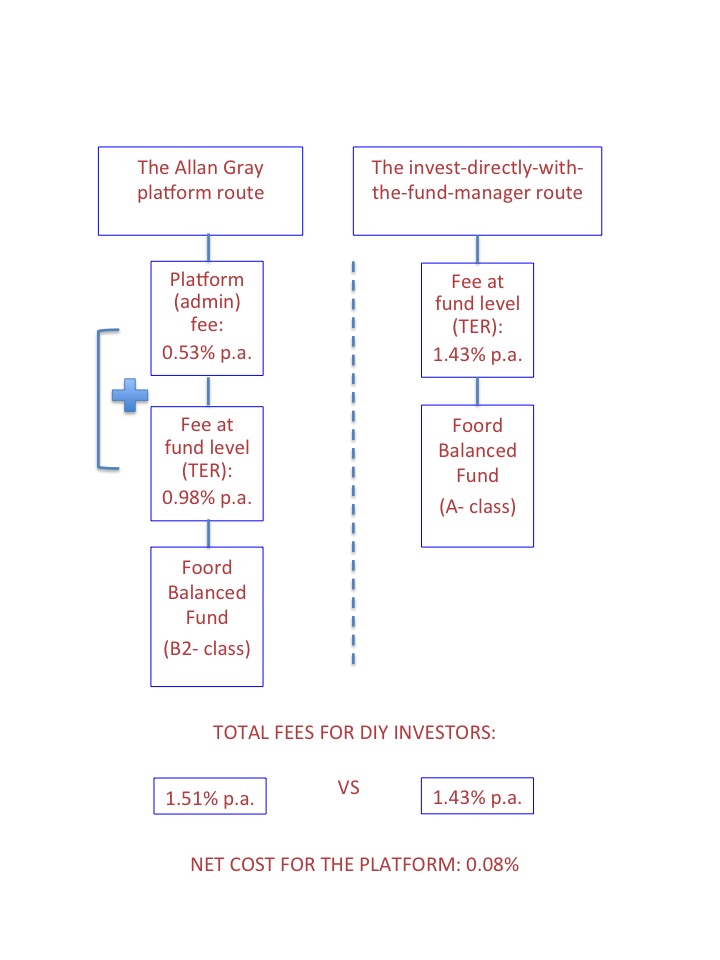

But these two perks come at a cost: paying away a platform fee (admin fee) of 0.53% every year. If you dig deeper the real extra cost of investing with third-party funds on the Allan Gray platform is not quite as bad as it looks at first glance. And that’s where things can get really confusing if you don’t know the industry and its use of different fee classes for the same fund. It’s best to use an example to explain the different classes.

I’m on the Allan Gray platform from which I chose the Foord Balanced Fund as one of the underlying building blocks of my retirement annuity product. If I instead invested directly with Foord and let them do all the admin and send me my tax certificates every year, Foord would have put my money in their default A-class of the Foord Balanced Fund. The total fees at a fund level for the A-class, also called the total expense ratio (TER) of the fund, is 1.43%.

But between Allan Gray and Foord they negotiated better fund fees, a total expense ratio of 0.98% for investors who invest in the Foord Balanced Fund via the Allan Gray platform. To facilitate this, Foord created a B2-class of the fund for platforms like Allan Gray. So, in effect, I’m paying 0.53 - (1.43 – 0.98) = 0.08% per year for the convenience of being able to monitor my Foord investment on the Allan Gray platform.

Image 2 (above): Investment platforms like Allan Gray negotiate lower fees with external portfolio managers hosted on their platform, bringing down the net cost of investing through a platform versus going directly to the portfolio manager.

The important point is, Allan Gray still charges an annual fee for their platform administration service, because they charge zero up-front fees (they have to make money somewhere), while there now are investment platforms that charge a zero monthly or annual platform admin fee, such as Easy Equities. And for long-term investors cutting out ongoing fees – a drag on them until the end of their investment lives - is more important than paying the small once-off transactional fees of companies like Easy Equities.

3 Active managers will protect your portfolio and that’s worth the higher fees.

Working in the active manager industry and perhaps sitting in too many of those presentations, I really believed the narrative that value managers (the majority of active managers in SA are value managers) can protect my portfolio from long periods of negative or poor returns. Sometimes that’s true, for example when Allan Gray minimised their exposure to Steinhoff before the news about the biggest fraud in the history of corporate SA broke. Other times, I just have to live with the disappointment. For example, on the offshore side Allan Gray’s Orbis Global Euity Fund has been down 10.4% over the past 12 months while the world index delivered a small positive return over the same timeframe.

But most painful has been my tax-free account, for which I chose the Nedgroup Investments Property Fund because I had very little exposure to the property asset class across my total portfolio a few years ago. The fund has delivered 0.4% p.a. over the past five years compared to its peers’ 4.3%. Inflation has been around 5% p.a. over the past five years. For the past 12 months the fund has been down 25.7%. I don’t exactly feel protected against returns that don’t beat inflation.

The worst thing to do now would be to switch out of these funds and lock in their losses relative to inflation. So, I’m staying put. But for my preservation fund and retirement annuity products I’ve slowly started switching out of the underlying active funds with ‘not so bad’ returns into the lower-cost passive balanced fund on the Allan Gray platform – the Nedgroup Investments Core Diversified Fund. Already it’s the underlying fund to which I have the highest allocation across all my products on the Allan Gray platform.

Will I ever hold everything I own in passive investments blindly tracking an index? Probably not. For as long as there are active fund managers that have proven over a long time that they consistently protect against large losses, such as portfolio manager Natasha Narsingh and her absolute return team, to which I allocate 50% of my money in my current employer’s pension fund, active managers still have a role to play in my life. No longer more than 50%, though.

4 ETFs are expensive for small amounts.

There are two ways to invest passively, also known as tracking the index. They are:

- unit trusts that track your chosen index, such as the JSE’s Top 40 shares

- exchange-traded funds (ETFs) that can track the same indices as passive unit trusts, but have different regulations and cost structures and, unlike unit trusts, you can transact throughout the day.

My main qualm with my current investment platform is that I’m restricted to unit trusts as the only underlying fund option. Up to a few years ago investing small amounts in an ETF locally was more expensive than investing in a passive unit trust. That’s changed dramatically. It’s now possible to invest in ETFs with a total expense ratio as low as 0.1% per year, for example the Satrix ALSI40, at zero annual platform fees through Easy Equities. Easy Equities charge once-off transactional fees, though, but these work out much cheaper than a unit trust if you invest for the long term.

My belief that ETFs are expensive has cost me dearly over the past couple of years since these low-cost funds and platforms first become available. It’s time to bring more of them into my total portfolio – via Easy Equities.

5 You need an offshore bank account to take money offshore.

Another trick that I missed is the more recent development of some investment platforms acting as a middle man to get your money offshore ‘properly’ – never needing to bring it back again when you need it one day.

Over the past eleven years I’ve been taking money offshore this way:

- Transfer money from my Nedbank account, getting Reserve Bank clearance, into my UK bank account – pay local and UK bank fees, as well as the rand/pound buy/sell spread.

- Then transfer money from my UK bank account – again paying bank fees and the pound/dollar buy/sell spread – into Allan Gray’s offshore dollar account, from where the money goes into a dollar-based offshore unit trust.

Two currency conversions; double the fees. Don’t be like Lizelle. Rather use the middle man service of someone like Allan Gray – if you prefer actively managed offshore unit trusts – or that of Easy Equities – if you prefer dollar-based offshore ETFs. That’s one currency conversion and significantly lower transaction costs.

Yes, one day you would need an offshore bank account to cash in the money, if you don’t want to bring it back to your SA bank account. But it’s not an essential when taking money offshore.

Now what? Where do I head from here?

My retirement products:

For now I’m staying on the Allan Gray platform for my private retirement investments, because when it comes to surgery and my retirement money, whoever is involved in the operations can never be too OCD. And from 12 years of dealing with them and doing work for them way back I know they’re obsessed about not making any mistakes with administration, valuation and transactions. But the underlying funds that I’ve chosen are slowly being switched into lower-cost passive unit trusts – as and when the poor performance of some of the active managers recover. And, who knows, maybe one day soon Allan Gray will add ETFs to the underlying fund options available on their platform.

For my retirement savings in my employer’s retirement fund, I’m currently 100% in two actively managed funds. As soon the trustees add passive funds, such as the Satrix Balanced Index Fund to the member options, I’ll switch half of that money into passive.

My offshore product:

I’m staying in the actively managed unit trusts until their performance recovers, and then the migration to passive funds will start. Any additional money that I want to take offshore in future will go via the Easy Equities dollar account into international ETFs – much more cost effective than what I currently have.

My tax-free account:

This was the last year that I made an allocation to my Allan Gray tax-free account. In future tax years a tax-free account with Easy Equities with a mix of local and international ETFs as the underlying funds is the low-cost solution I’m looking for.

Do I still have blind spots and biases? I think we can take that as a given. But slowly my long-held beliefs are becoming unstuck. As I offload some more fees along the way, the journey ahead looks brighter and lighter.