Could your older self style it financially? - Discovery retirement tool

By Lizelle Steyn

6 October 2019

And so we came to the last night of our first trip to Greece, which naturally led my partner and I to discuss when we can kiss office life goodbye and start living a more outdoors and active life – every day. Mostly a simple life but always with some travel, exploration and new learnings on the horizon, without any obligation to earn an active income. And, in my case, a more meaningful life with plenty of time to work on projects that make sense to me. In other words, financial freedom – the final milestone of our 10-step financial plan.

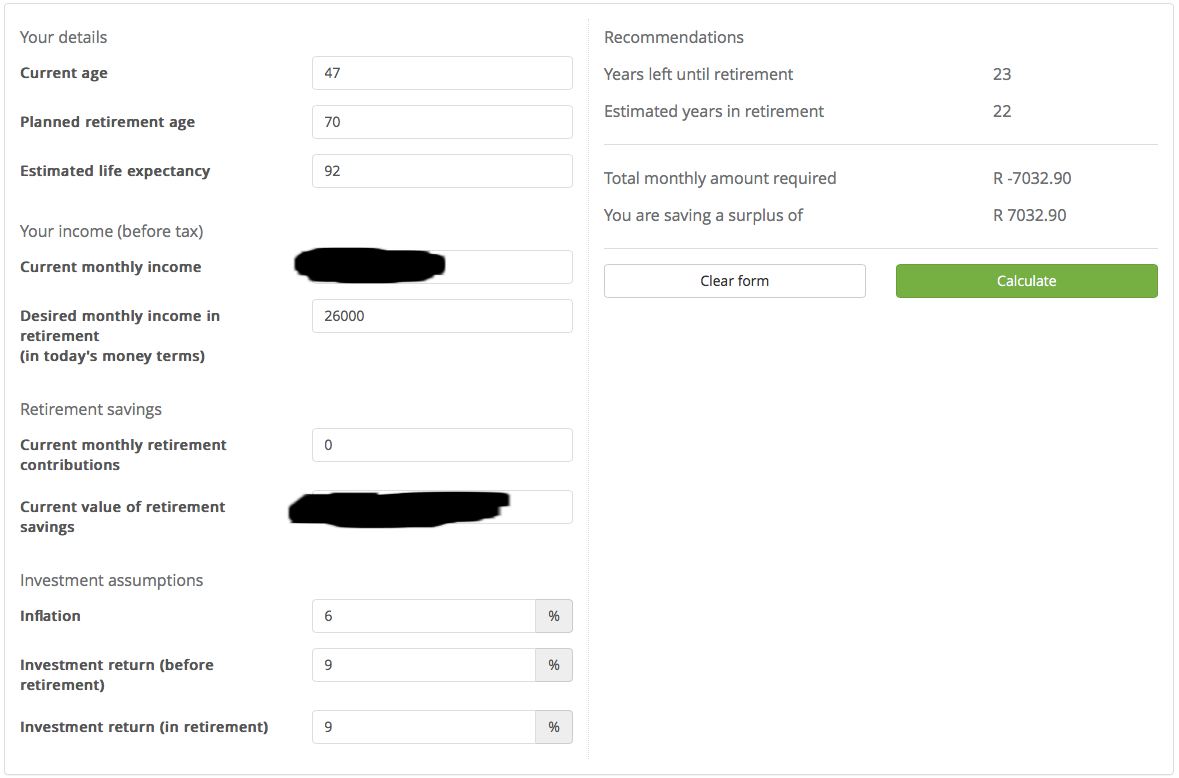

Well, that was after I played around with the Discovery retirement tool to first make 100% sure that I’ve already reached the milestone where I no longer need to save up for Tannie Lizelle at age 70. Let’s be realistic, after 70 summers I might not feel like working anymore, or may not have the good health and energy needed to pitch up and keep clients happy. So, I’m making sure – as far as I can control my own destiny – that I won’t need to earn an active income after age 70.

(2020 update: Above is how the Discovery interface used to look: nice and customisable for the FIRE community. The new 'simplified' version looks nothing like the above and has become painful to try and use.)

Yes, the calculator confirms that even if I invest zero per month from now on for the next 23 years, that’s still a surplus. If I just leave everything I’ve saved up across my retirement products, tax-free account and offshore unit trusts, and only start drawing from those investments at age 70, I’ll have enough to draw an income of R26 000 per month in today’s terms.

Milestone 8 of my 10-step plan to financial freedom has been reached.

There is the minor detail that even though I can stop saving for my older self now, I still need to earn an active income of around R26 000 a month for the next 23 years until age 70 to live off. From where I’m standing, 23 years sound like a very long time. So, for now I’m staying in my job where I earn more than R26 000 and I keep on saving the excess, giving myself a chance to reach financial freedom, with a target amount calculated using the 4% rule, before age 55.

Next we moved on to do the same calculation for my partner.

This is where things started to slow down. And it had nothing to do with the Greek wine. There were certain fields that he wasn’t sure how to complete. Other than the fact that my partner is an intelligent human being, he also works in the industry - he’s an insider! But even he needed me to talk him through some of the terms and what exactly they meant.

So this blog post is for everybody out there who’s ever played around with a retirement calculator but got stuck and eventually gave up trying to figure out whether they’ll be OK in old age or not. This week we’ll use the Discovery tool and I’ll walk you through the input fields step by step. Next time we’ll tackle the 10x calculator. (December 2020 update: The Discovery retirement tool has been simplified to the point that very little customisation is currently possible. Don't waste your time on this one.)

Current age

That’s exactly what you think it is: your actual age – now.

Planned retirement age

There should be no doubt about this one either. (After you’ve entered all the data fields below and did the first round of calculations you can play around with this age, making it later if you have a shortfall and bringing it closer if you have a surplus in the result.)

Estimated life expectancy

The weirdest field to complete and highly personal. I use the age of my ancestor that lived the longest and died from natural causes (Ouma Kowie in my case) and then add 10 years to make provision for the advances in medical technology since her lifetime. Most financial planners use 99 to be safe.

Current monthly income

Discovery doesn’t use this figure to calculate whether you’re saving a surplus or have a shortfall. You can enter any positive figure you like – it doesn’t matter. What matters very much is the next field, your desired monthly income.

Desired monthly income

If we could ignore tax, this field would be equal to your current monthly expenses. Yes, some of your current expenses, such as work clothes and transport to work, would fall away in retirement, but your medical expenses normally increase. It should be fine to work with your current total annual expenses – considering once-off annual costs such as a holiday and your car and other license renewals or subscriptions – and then divide that figure by 12 to get your expected monthly expenses.

Even if we ignore tax – it won’t go away, though. Tax laws could still change a lot between now and your retirement date, but currently they are as follows:

- withdrawals from your tax-free savings account trigger zero tax – yay!

- dividends from shares and ETFs and unit trusts are taxed at 20% if they’re not ‘wrapped’ in a tax-free account or retirement product

- capital gains on the sale of unit trusts and ETFs are taxed (at most) at 40% of your income tax bracket (e.g. 0.4 x 0.36 = 14.4%) if they’re not ‘wrapped’ in a tax-free account or retirement product. Fortunately, not all of the money you get when you sell unit trusts or ETFs is a gain (profit). The money you get back into your bank account is also made up of your own contributions (no tax on that), dividends and sometimes interest earned.

- regular withdrawals (annuity income) from your retirement products after retirement are taxed at the rate of your personal income tax bracket (see the SARS tables), but the first R500 000 of your once-off retirement lump sum withdrawal at retirement date is tax-free

- rental income is taxed at the rate of your personal income tax bracket as per the SARS tables

- interest is taxed at the rate of your personal income tax bracket, with the first R34 500 per tax year exempt for over 65s.

As you can see, how much tax you’ll be paying in retirement hugely depends on how you’re invested. But for this exercise we need a general guideline that will work for most people… If you’re currently putting the max possible every year into a tax-free savings account and continue to do so until your lifetime limit (currently R500 000) is reached and also use the tax-efficiency of retirement products, and don’t need more than R30 000 per month in retirement, you could get away with not paying more than 10% tax effectively on your monthly withdrawals.

Back to the data field. If you don’t need a monthly income of more than R30 000, a very general guideline is to add about 10% tax to your expected monthly expenses and enter that as your desired monthly income.

Current monthly retirement contributions

Add up everything you’re saving into retirement funds, your tax-free account, ETFs and unit trusts – i.e all your monthly savings into long-term investment products. The Discovery tool doesn’t explicitly say it, but we can assume that their calculations assume you would be increasing this amount by inflation every year.

Current value of retirement savings

For us FIRE people who are not only saving via retirement products, this would be the total current value of all your retirement products, your tax-free savings account, your ETF, unit trusts and other investments, excluding the property that you’ll be living in after retirement.

Inflation

Over the past 60 years the average inflation rate in SA has been 7.7%, with many ups (notably the 1980s with double-digit inflation) and downs. Since 2000 when the Reserve Bank formally started to target inflation of between 3% and 6%, it’s been mostly successful in keeping inflation under control. Over the past 10 years to September 2019 consumer price inflation has averaged around 5% per year. I use 6% - just in case rand weakness in the future (South Africans still import a significant portion of what we consume every year) pushes inflation towards the top end of the Reserve Bank’s target band.

Investment return (before retirement)

In the previous century, returns of about 5% more than inflation were the norm for diversified portfolios with a large share (equities) component. There are now investment specialists who believe that, due to the unusual monetary policies since the Great Financial Crisis of 2008, we might have entered a period of sustained lower returns. In case they’re right, I expect my diversified portfolio to deliver 4% more than inflation over the long term, but to err on the conservative side and make sure that my older self will have enough money, I use 9% for the Discovery tool (3% more than my inflation assumption.) Should my portfolio then return 10%, that will be a bonus.

Investment return (in retirement)

The same thinking as above. I might decrease my total allocation to the share (equities) asset class across my retirement products, ETFs and unit trusts to only 50% to get a slightly smoother ride after age 70, but I don’t expect to invest so conservatively as to receive a return that doesn’t beat inflation by 3% per year on average.

Now it's your turn to run the calculation.

Result:

Total monthly amount required

This is what you need to save per month across all your long-term investment products. You would need to increase this amount with inflation every year.

You need to save an additional/You are saving a surplus of

If the amount you’re currently saving is less than the monthly amount required, the tool tells you what you need to invest in addition to your current monthly savings. If you’re at your budget’s edge and can’t fork out any more for investments, increase your planned retirement age and recalculate the result. Repeat until the tool lets you know that you are saving a surplus.

But will my money last?

It’s important to remember that you absolutely need to get to the investment returns that you’ve chosen for your portfolio before and in retirement – after all costs, including a platform fee and any adviser fees, have come off – or your money won’t last until your estimated last birthday. The Discovery tool assumes you or your adviser will be managing your portfolio; you will not be handing your money over to an insurer to buy a guaranteed annuity income for life.

Critique of the Discovery tool

An age slider, as well a slider for your current retirement contributions would have been handy to make this tool easier to use. But once you get the hang of it, it turns out to be one of the better tools (specifically in terms of flexibility) out there. It doesn’t tell you that you need to aim for a replacement value (an old-fashioned actuarial term relating to your salary); it lets you set your desired retirement income. It also allows you to ‘retire’ before age 55. My partner thought they should have showed the total investment value that you would need in your portfolio by retirement age too; I feel that less information might be better for DIY investors. There’s already a lot of terminology to look at on the screen and – especially if retirement is still a long way off. Maybe all you need to know now is how much you need to save every month for retirement at different chosen ages. Maybe Discovery could have been more imaginative visually when they designed this tool. Still, I give it 7/10. Good enough. Avoid the new version of the tool. It will frustrate you.