Investment fees: the clear, the hidden and the plain hairy

By Lizelle Steyn

31 October 2019

The FIRE movement is obsessed with fees, with good reason. These goblins persistently nibble away at your portfolio’s performance and the difference between paying 2% per year instead of 0.5% in an otherwise identical investment means you’ll take a whole two years longer to treble your investment amount.

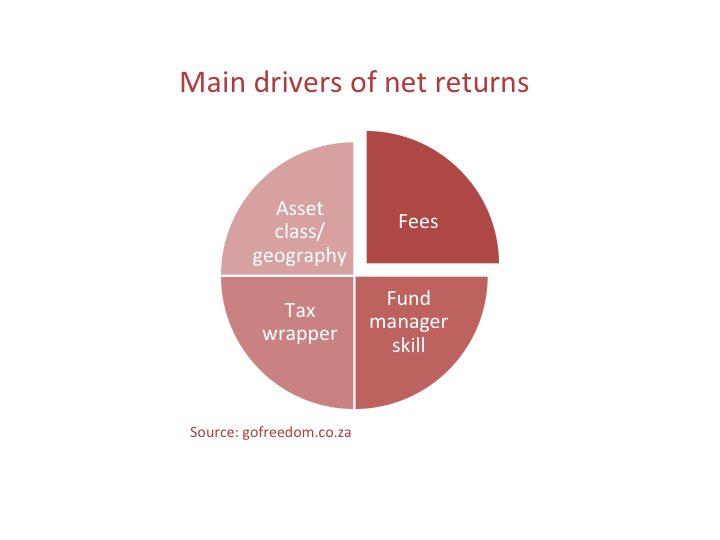

For the record, despite being insidious performance slayers, fees are not the number one driver of disappointing net returns. Asset allocation – whether you’re in equity, property or interest-bearing assets – and also which geography you’re invested in can cause the biggest gap between investor A and B’s returns, if A is invested in a share index over 20 years and B in cash over that same period, for example. And if you’re a high-income earner, being in the right tax wrapper is probably your second most important driver of strong net of tax returns. The fourth factor, fund manager skill, may or may not contribute positively to your returns.

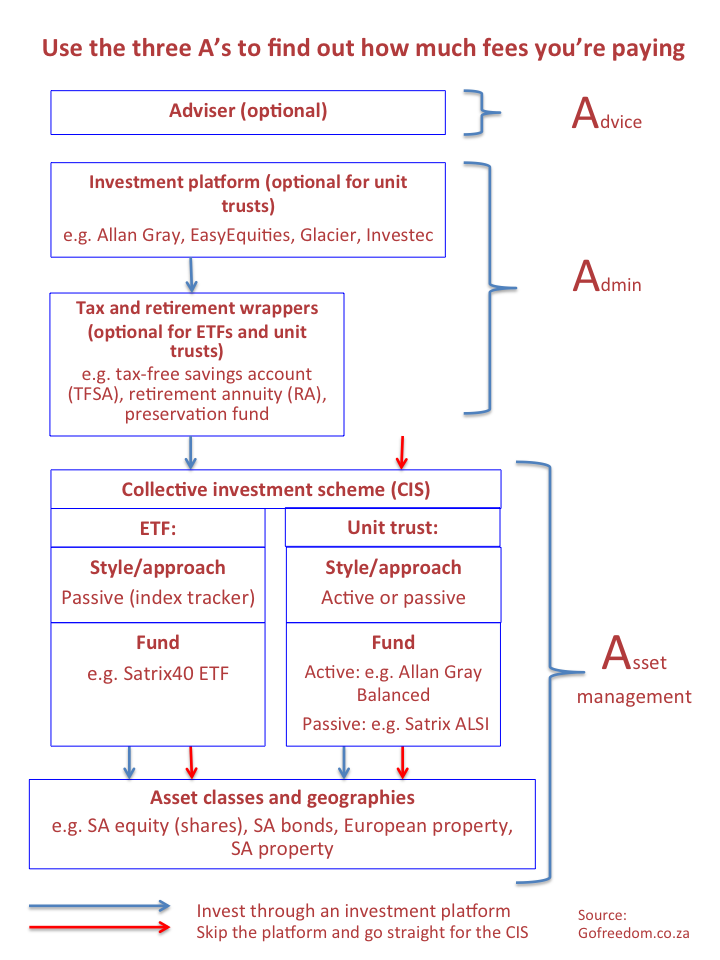

Still, fees need to be hunted down no matter how deep they’re hiding and exterminated if they’re for a service that adds no value to your life. In last week’s post you met all the layers your money moves through when you hand it over to the investment industry, and you’re absolutely right if you thought: so many places fees can hide!

So, how do you find out how much you’re really paying? In total. On everything.

To its credit, the industry has made some progress in terms of transparency and the more client-friendly businesses actually point out to investors that they need to look out for three categories of fees. They are what my colleague Richard calls the three A’s of investment fees:

- Advice;

- Admin;

- Asset management.

With these three categories in mind, I’ve taken last week’s layers diagram and added the advice level, so we can be sure we’re searching your investment’s coat pockets for all fees.

Let’s tackle the categories one by one.

1 Adviser fee

Nowadays, most investment companies are set up to deal with investors directly. So, technically, you don’t need to use an adviser – if you’re willing to do a fair amount of research yourself, speak to different people who have been in the game a long time, and you can handle the different and often conflicting opinions that come your way. You’re bound to come across some strong opinions, firmly held. But those who give the best advice are those who have strong opinions, loosely held. Therefore seek out advice from those who are constantly monitoring the investment landscape and who sometimes doubt themselves, for they are more likely to have considered the multiple possible avenues of investing.

I recommend using a financial adviser or tax specialist when:

- You don’t have the time or desire to research the different options available

- You need someone to monitor you in case you do something incredibly destructive like cashing in a long-term investment within a year or two of investing because it’s giving you less than the interest rate your bank offers you

- You’re only a few years away from retirement and need to know which tax and retirement structure would be optimal

- You’re about to retire and need to find out how much of your one-third cash allowance you should actually take in cash – to minimise your tax

- You need to set up a testamentary trust for minors

- You earn offshore income or have offshore investments and need a cross-jurisdiction view

- You have generally complicated tax affairs

Some of the best advisers charge per hour. Or they’re open to either an hourly rate up-front or an ongoing annual fee. Get a quote and then do the calcs to figure out whether up-front or ongoing will probably work out better for you. Normally, an hourly fee works out better for people with large amounts to invest. For small amounts an annual fee may work out cheaper. Between 0.5% and 1% per year is standard for the annual fee model. If you have more than a million to invest, you should be able to negotiate the 0.5% deal with your adviser.

With the annual fee model, you should get a call every year from your adviser checking in on you and updating you on your investment. If your adviser goes silent on you or, worse, don’t answer your calls, you have every right to cancel the annual adviser fee. A friend of mine whose adviser uses the Allan Gray platform never informed her about the launch of tax-free saving accounts on the platform and she was unnecessarily paying the 20% dividends tax because she was still in the normal, taxable unit trust (not ‘wrapped’ in a tax-free savings account). After several no-replies to her queries around tax-free, she asked Allan Gray to remove him as her adviser. The annual adviser fee was cancelled.

2 Admin fee

A platform - also known as a LISP - gives you access to either of the two most popular collective investment schemes available in SA, a unit trust fund or an exchange-traded fund (ETF). The admin or platform fee is what you pay for the pricing of your investment, the handling of transactions, the annual tax certificates, your digital interface with your investment and other communication, as well as the right to view and buy ETFs or unit trusts from various product providers/fund managers on one platform. It’s like using AirBnB instead of dealing with the host of the holiday accommodation directly.

Important distinction: Admin/platform fees could be either annual or charged per transaction. For long-term investors, pay-per-transaction is almost always cheaper than an annual fee. For example, if you’re paying away 0.5% of the value of your investment when investing and again 0.5% when you cash it in five years down the line that beats paying 0.5% every year over those five years.

Unit trust platforms:

Pay-per-transaction admin/platform fees for unit trusts are still rare in South Africa, with the majority of platforms charging annual fees. Be on the look-out for new platform entrant ZAR-X that will offer unit trusts at no annual admin/platform fee, only a transactional admin fee. As they’re not up and running yet, it’s unclear how much of a discount they’ll be able to negotiate with the asset manager to bring down the underlying unit trust’s asset management fee. With established platforms, this discount is substantial.

Most platforms that offer unit trusts charge one combined fee for using their platform and for using their tax-free savings or retirement annuity account. In South Africa the annual admin/platform fee for unit trust platforms is generally 0.5% + VAT = 0.58%. If you invest more than, say, R1m or R1.5m this fee starts to drop according to a sliding scale. If you have less than R1m to invest, you’re most likely paying 0.58%.

There’s a trick with annual admin fees, though. Their real impact on you is often not as bad as 0.58%. That is because the large LISP platforms like Allan Gray and Investec often negotiate a lower asset management fee with the provider of the unit trust - the fund managers outside of their own brand - which they host on their platforms. Like Coronation and Nedgroup Investments. You get access to a special fund class of that unit trust fund that’s cheaper than if you bought the unit trust directly from the fund manager.

Yes, not using a platform, but investing directly with the fund manager is still cheaper. But bypassing the platform would also means an additional admin burden, having to collect statements and tax certificates from every unit trust company you're invested in. Also, if you're not on a LISP platform like Allan Gray, you won’t be able to easily switch from, say, the Foord Balanced Fund to the Nedgroup Core Diversified Fund, for example. If I didn’t use a platform offering several companies’ unit trust funds, I would have had to cash in my money with Foord, wait till it shows up in my bank account and then complete an application form with Nedgroup. Via a platform all of this happens seamlessly – and that’s what I’m paying for.

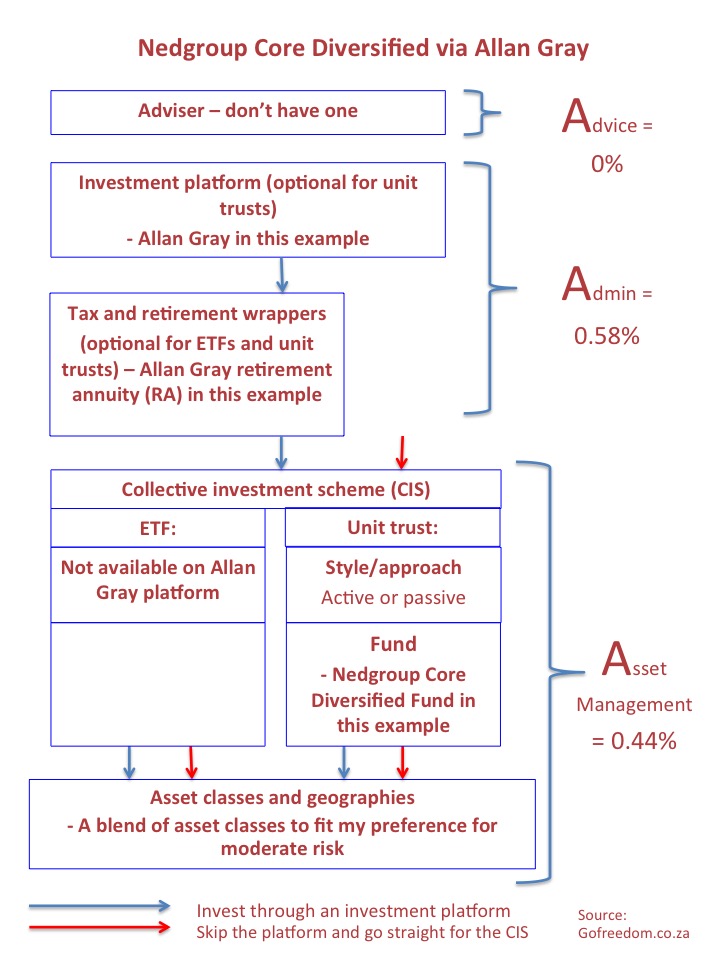

Talking about switching, earlier this year I did switch some of the better performing unit trust funds inside my Allan Gray RA to a lower-cost passive unit trust, the Nedgroup Investments Core Diversified Fund. The diagram below shows what I now pay in total for using the Allan Gray platform, the RA wrapper and the passive unit trust: 0.58 + 0.44 = 1.02% per year.

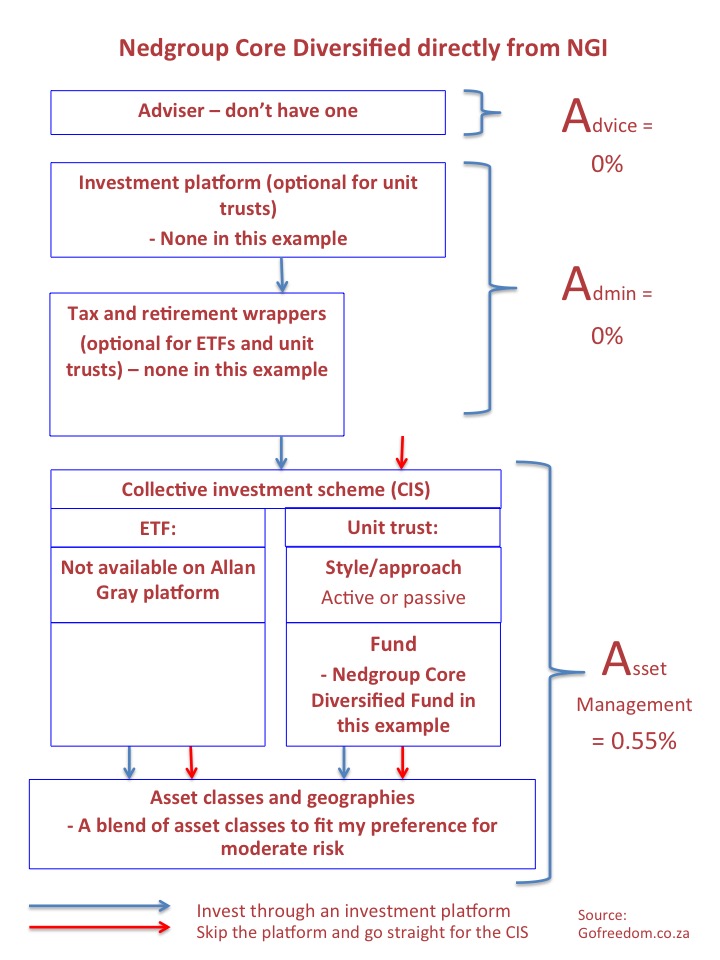

Did I buy this passive unit trust directly from Nedgroup (the red route), it would have cost me only 0.55% per year, as shown in the diagram below.

I've since found out that Nedgroup now offers an RA. The company says its RA has a zero admin fee - only an asset management fee. But the catch is that the class of the fund that you're invested in when you enter the fund via an RA charges 0.72% - that's more than if you invested directly into the fund. It's still less expensive than investing in the fund via the Allan Gray platform, though. It's actually sometimes really difficult to find out which class of the fund you will get from the business. The call centre often doesn't know. But be persistent - try and get hold of the fund manager directly, and if he/she doesn't know (it's crazy but this happens) ask to be referred to the product manager who decides on the pricing of different funds and their fund classes.

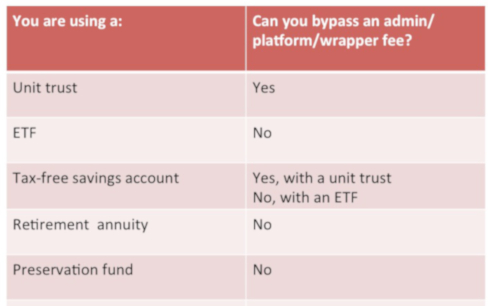

Below is a summary of when it’s possible to bypass a platform and/or wrapper and accompanying admin/platform fee and when it’s not:

It seems we’ve covered most of the intricacies of the unit trust platform. Time to move on to ETF trading platforms.

ETF platforms:

A few years ago trading in and out of exchange traded funds (ETFs) was prohibitively expensive, which partly explains the dominance of unit trusts in the local industry. But tech advances have brought down ETF fees dramatically.

For ETFs, Easy Equities is currently the most affordable trading platform – if you’re investing for more than three years. It’s also cheaper than any platform offering unit trusts. Here is the Easy Equities cost sheet. Nice. No annual fees at platform level, unless you use their RA wrapper. For a TFSA or standard taxable ETF you only pay per transaction. Careful, though, the cost breakdown on the Easy Equities site does NOT include two potentially substantial costs:

- asset management fees; and

- the buy/sell spread on ETFs.

Asset management fees we’ll discuss in detail below; it’s the third category of investment fees.

The buy/sell spread on ETFs gets hairy. You won’t be able to find that online. On most platforms it varies throughout the day, depending on how many people are trading the ETF. It means there’s a different ETF price for buyers and sellers of the ETF, and the difference is actually another cost to the investor. A general rule to keep this spread as low as possible is to trade on busy platforms with large volumes of buyers and sellers of the ETF you’re interested in. Also, avoid more obscure, less popular ETFs.

A last word on platforms: low fees are not everything. You need good service, reliability, transparency, accuracy and convenience. That’s what you’re paying for.

3 Asset management fees

It’s a common misconception that ETFs don’t have a fund manager. But somebody – often an entire team - has to manage the fund, rebalance and make sure it tracks the index as closely as possible. ETFs therefore have similar types of fees to a unit trust: fund management, custodian, bank, transaction – the list goes on. Fortunately they’re much smaller in size than an actively managed unit trust.

Where do you find the total asset management fees? Online, on the ETF or unit trust’s fund fact sheet, also known as the minimum disclosure document. All the fund management costs should be combined into the total investment cost (TIC) of the fund. The TIC is always an annual fee and varies slightly from month to month.

TIC: Memorise this acronym; we’ll be using it a lot.

TIC = total investment cost = total asset management fees = total fund management fees. Theses are the different names the industry calls the same thing. It’s everything you’ll be paying for the fund except the admin/platform fee and the adviser fee.

Sometimes only the total expense ratio (TER) of the fund is shown on the fund fact sheet. In that case, add up the TER and the figure called transaction cost (TC) to get the TIC. Transaction cost in this context refers to the transactions the fund makes as it buys and sells assets; not the transaction fees of the investor. But the cost gets borne by you, the investor. You pay for the fund manager’s transactions. It needs to be included to get the full TIC. These fees vary from month to month.

Only five years ago ETFs were expensive unless you had large amounts to invest. Now, often they’re cheaper than any unit trust fund tracking the same index. You need to research both. For example, at the moment the Satrix 40 ETF has a TIC of 0.14%., while the Satrix 40 unit trust has a TIC of 0.66%, which largely explains why the Satrix 40 ETF is outperforming the Satrix 40 unit trust fund. (The returns on the fact sheet are already net of the TIC; no need to deduct it.)

But keep in mind that with an ETF, unlike a unit trust, you need to use a trading platform, with all the accompanying admin/platform fees mentioned earlier in this post. So, your net return shown on the fund fact sheet needs to be reduced by your admin/platform fee.

If you want to track a particular index but do not want to pay a platform fee, check whether a unit trust company tracking the same index perhaps has a unit trust at a similar TIC than the ETF tracking the index. It’s rare, but you could end up paying less fees in total if you go the passive unit trust route and skip the platform. I repeat, you need to research both the cheapest ETF and unit trust tracking the index you want. Whichever way, always add your platform fees to your ETF or unit trust’s TIC to pin down the total fees you’re paying. This gets complicated when you’re adding a pay-per-transaction fee to an annual fee. You will need to make assumptions around how long you’ll be invested before you sell the ETF. To make it even more complicated, the added bid/offer spread on an ETF remains unpindownable (neologism).

If you prefer unit trusts or for the moment have to use them because of the platform you’re already signed up with, the actual asset management fee you’re paying may not be aligned with the TIC of the fund fact sheet that you’ve googled. Allan Gray may be expensive but they’re great with transparency. When you log into your account, your adviser, admin and investment management (= fund management = asset management) fees are set out for each account at the bottom of the screen. Your asset management fee should be lower than the TIC of the fund fact sheet that you’ve googled, because of the platform’s power to negotiate this fee down for its clients. Here is also a fund list table with all the funds on the Allan Gray platform with their TICs. All the fees in this table include VAT.

If your platform doesn’t show the TIC of all the funds that they offer online, contact them. They have to disclose all these fees.

Fortunately for investors, the race to the bottom is on. The cheapest ETF in the country is currently the Satrix 40 – with a TIC of only 0.14%. Included in this is a TER of 0.1% and a transaction cost of 0.04%. Internationally, Fidelity has already introduced a zero-fee ETF. The loss that they make on this product comes from their marketing budget and this interesting interview with the CEO of Fidelity sheds some light on why they have this loss-leader.

VAT – in our out?

Something that’s easy to overlook is whether the fees you’ve tracked down in your epic investigations are inclusive or exclusive of value-added tax (VAT). Remember to only compare like with like: either incl or excl VAT.

Investment fees that no one should be paying anymore

In our parents’ time there used to be investment policies and plans with actual penalties if you stopped your monthly contributions or wanted to cash in your investment. Hopefully no-one reading this is in any of these products. They belong in the previous century and should be avoided at all cost.

Investment fees have come a long way – down

If only these low-cost funds and platforms were available when I started my first investment account over a decade ago... It’s now possible for DIY investors to invest for less than 0.5% per annum – including all investment fees across the admin and asset management layers. That’s less than a quarter of what I was paying 10 years ago and am still paying on some of my unit trust funds. But, not for long.